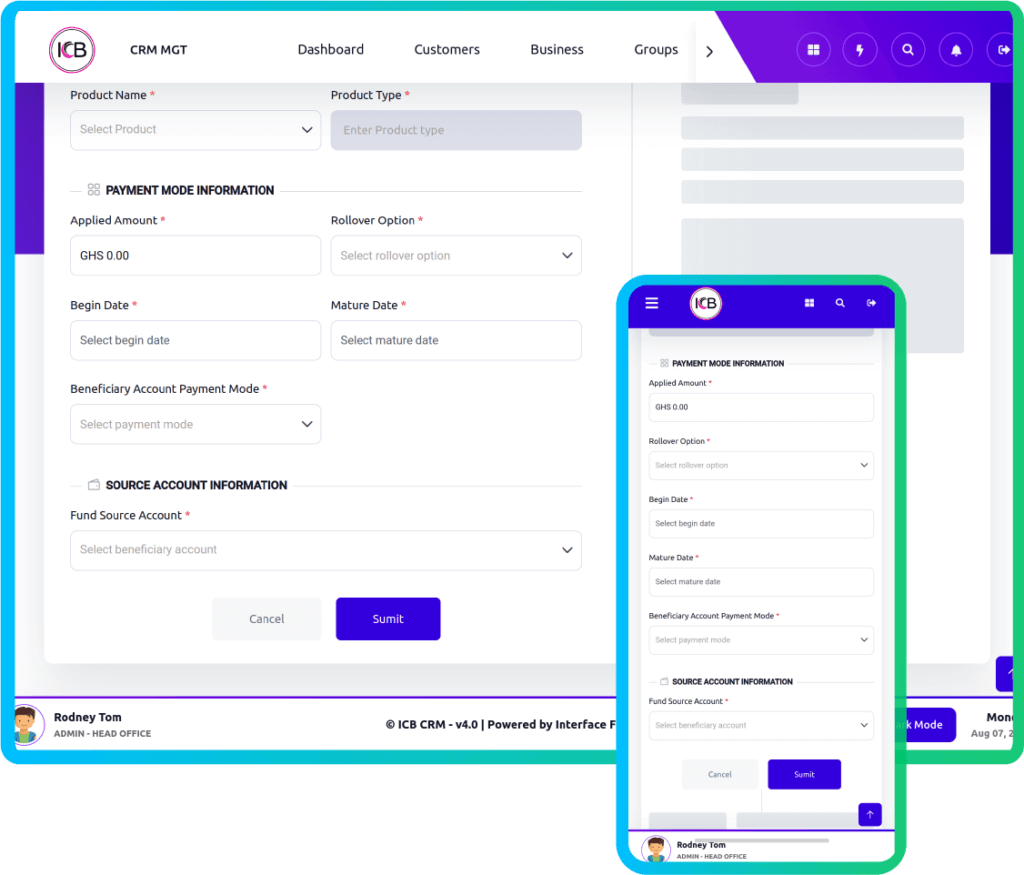

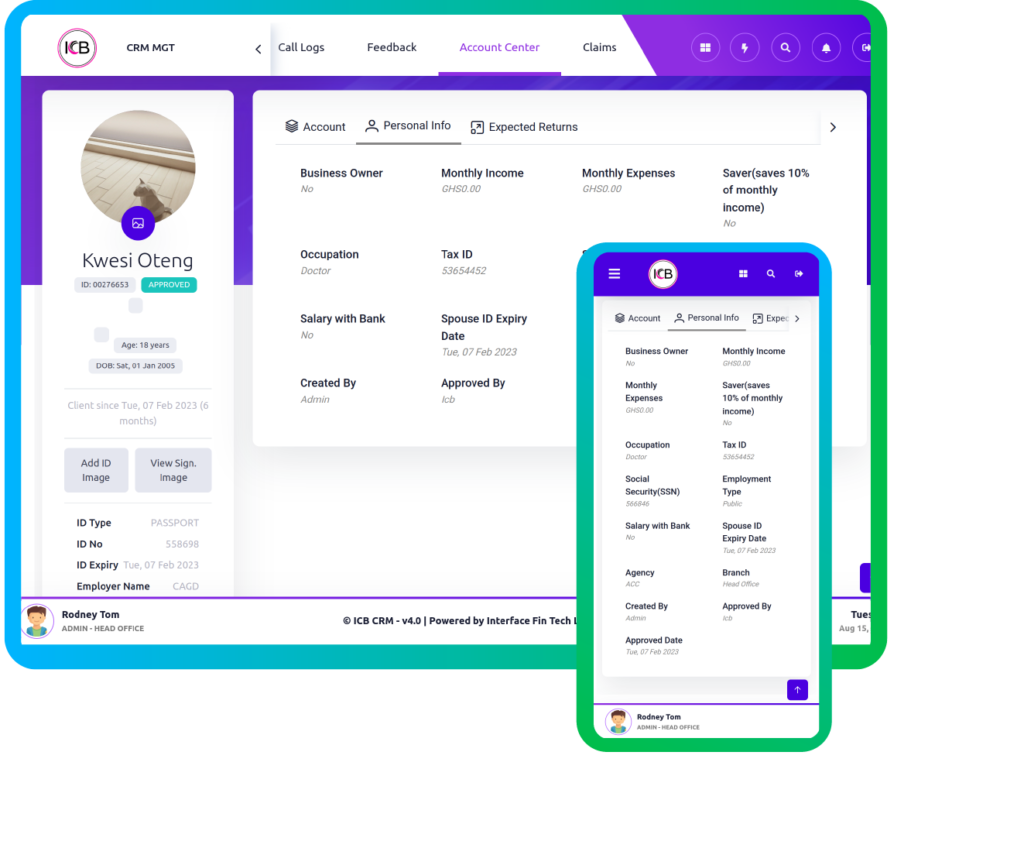

We empower financial institutions build great banking experiences

We enable financial service providers with our platforms to build great banking experiences that their customers and employees love; in a faster and more cost effective way.

We empower financial service providers to get closer to their customers like never before, create 10x better banking experiences and grow revenue by given their customers personlized journeys without limits.

Welcome to your new way forward where we utilize our platforms, knowledge, expertise, and services to assist financial service providers in creating future-ready innovative financial solutions unique for everyone, anywhere, at any time in weeks not months.

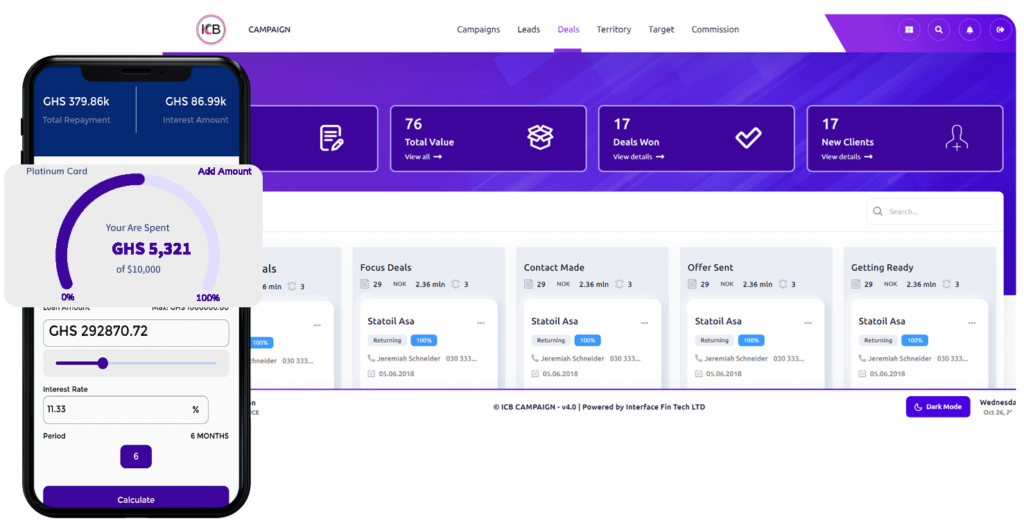

For banks

Our platforms empower banking and non bank financial institutions to build and deploy digital-native banks in days.

- Core Banking

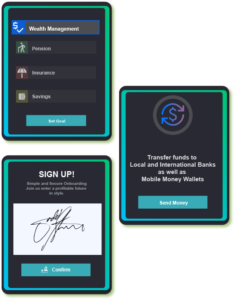

- Digital Banking

- Open Banking

- Mobile Banking

- Social Media Banking

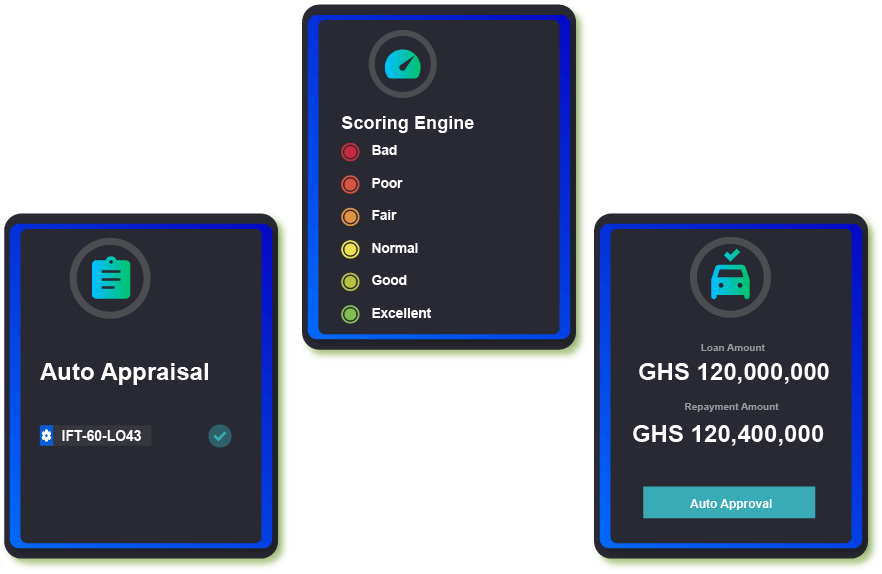

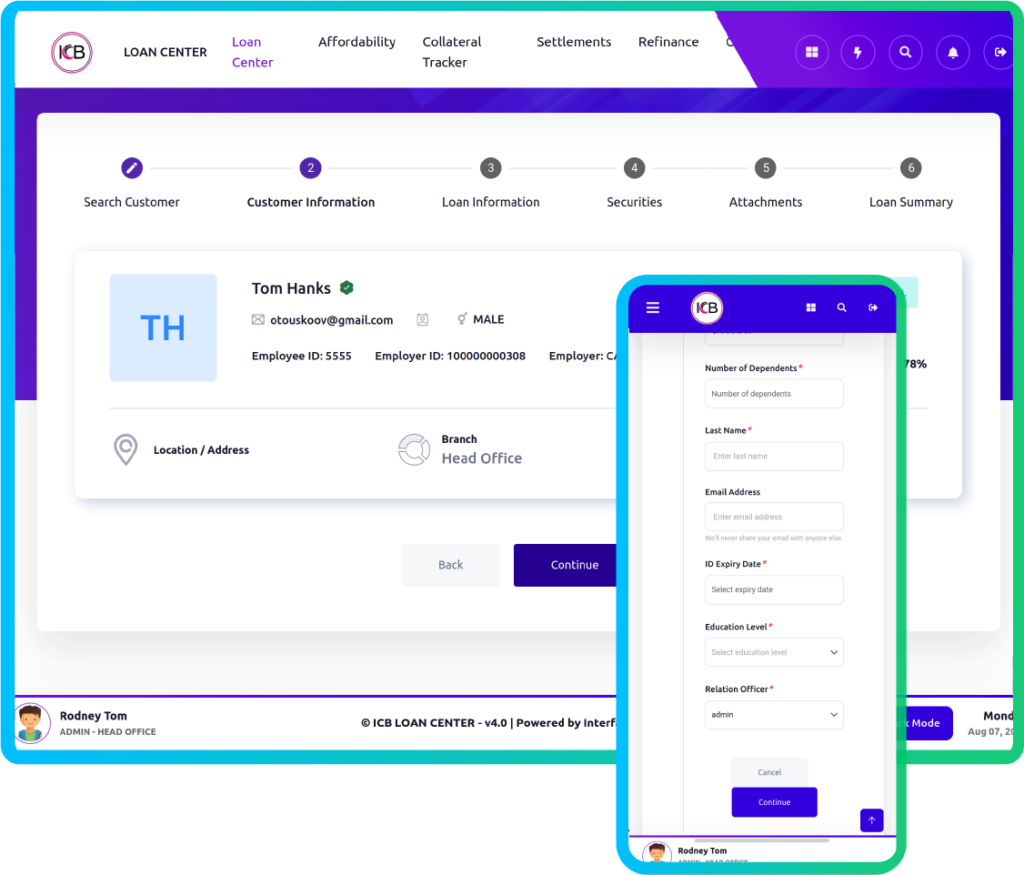

For lenders

Build a world class lending business with our lending platform for banks, fintechs, retailers, corporates for variety of loan offerings tailored to customers needs from the onboarding to collections with easy integration and credit scoring

- Payroll Lending

- Salary Advance

- Overdrafts

- SME Lending

- Buy now Pay Later

- Purchase Financing

- Embedded Finance

- Buy now Pay Later

Banxy was born of Natixis’ desire to complement their business with a low-cost retail banking proposition Launched in just eleven months, it became Algeria’s first 100% mobile bank and has been able to sustain an edge by being the first to market with unique customer-focused products and services. In its first six months, Banxy garnered over 100,000 app downloads with a client acquisition cost of 13 euros per client and an IT budget of 16 euros per client.

Banxy was born of Natixis’ desire to complement their business with a low-cost retail banking proposition. Launched in just eleven months, it became Algeria’s first 100% mobile bank and has been able to sustain an edge by being the first to market with unique customer-focused products and services. In its first six months, Banxy garnered over 100,000 app downloads with a client acquisition cost of 13 euros per client and an IT budget of 16 euros per client.

Banxy was born of Natixis’ desire to complement their business with a low-cost retail banking proposition. Launched in just eleven months, it became Algeria’s first 100% mobile bank and has been able to sustain an edge by being the first to market with unique customer-focused products and services. In its first six months, Banxy garnered over 100,000 app downloads with a client acquisition cost of 13 euros per client and an IT budget of 16 euros per client.

Banxy was born of Natixis’ desire to complement their business with a low-cost retail banking proposition. Launched in just eleven months, it became Algeria’s first 100% mobile bank and has been able to sustain an edge by being the first to market with unique customer-focused products and services. In its first six months, Banxy garnered over 100,000 app downloads with a client acquisition cost of 13 euros per client and an IT budget of 16 euros per client.

Fidor Bank is Europe’s original digital bank. It has been recognized for its disruptive, transparent approach to banking, creative use of social media, and unique, customer-focused services. A pioneer in the sector, Fidor enables its one million+ customers to actively participate in the bank’s decision-making processes. In 2019, Celent recognized the bank for its pre-integrated customer marketplace, which provides customers with a hyper-personal banking experience.

Are you a Startup About to disrupt?